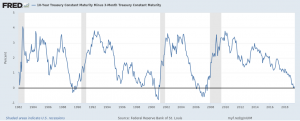

The yield curve is a subcomponent in the Interest Rate indicator in TJT Capital Group’s proprietary InVEST Risk Model®.

The yield curve inverted briefly in March (3/22 to 3/29) and inverted again yesterday (5/13). An inverted yield curve is when short-term rates are higher than long-term rates.

The significance of an inverted yield curve is that it preceded the last three downturns as seen in the chart below, and has also preceded every recession over the past 50 years.

Schedule an appointment to speak with an advisor to learn how TJT would manage your investment portfolio.